President Joe Biden says the US would defend the island, but its military isn’t ready.

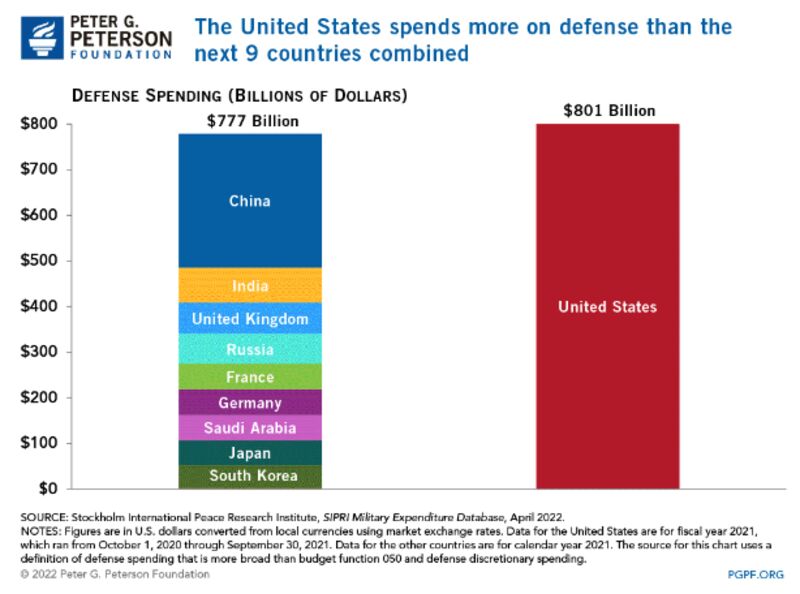

When $801 Billion Isn’t Enough

When you see a chart like this, it’s easy to assume the US would have no problem trouncing China or anybody else in a war:

After all, spending is strength, as the brands are always telling us.

But as anybody who has ever ridden in a US Army Ground Combat Vehicle can tell you, not all defense money is spent wisely. (Fun fact: Nobody has ever ridden in a US Army Ground Combat Vehicle.)

And in an actual war, military power becomes subject to stock versus flow issues. Yes, the US military has spent bajillions on expensive weapons systems. But when the shooting starts, all of those pricey blow-’em-ups tend to blow up at an alarming rate. There’s no better example right now than the Ukraine war, Hal Brands notes. Artillery shells, missiles, tanks and other materiel are dematerializing almost too quickly for Russia and the West to keep up.

Now imagine a much more evenly matched war — say, one between the US and China over Taiwan. The difference in such a conflict may come down to who can replace their equipment the fastest, Hal writes.

Once upon a time, in World War II, the US had a wide lead over the rest of the world in this skill. But its economy was heavily industrialized then, and it still took years to fully militarize.

Today the US economy is based mostly on lattes and vibes, while China is still the world’s factory. And though it hasn’t spent as much as the US, it’s been cranking out war machines. President Joe Biden last night suggested the US would defend Taiwan against a Chinese invasion. But unless he starts preparing now, the war will probably be lost before it even starts. Read the whole thing.

Bonus New Cold War Reading: China is flooding the world with propaganda. — Adam Minter

Everybody Puts Putin in a Corner

China will also have the benefit of watching and learning as its client state Russia pratfalls through Ukraine like the Three Stooges at a construction site. After nearly seven months of failure and war crimes, Vladimir Putin is running out of friends abroad and at home, Clara Ferreira Marques writes. Nationalists are pushing him to press more of his citizens into the fight, but that will make him even more unpopular — maybe regime-endingly so. Full mobilization also won’t be easy, and at this late date it might not even be effective. Turns out invading a country for no good reason is a bad idea!

Wall Street’s Glass Is Half Full and Also Half Empty

We’ve used Schrödinger’s cat half to death (get it?) in this newsletter, but here we go again. John Authers writes Wall Street is just about evenly split between a camp of bulls — who see the Fed landing the economy gently and easing off on rate hikes next year — and bears, who see the opposite of that. We exist in a quantum superposition of economic eigenstates ranging from “We were all worried for nothing” to “Time to load your belongings in a grocery cart.” It will be fun watching this wave function collapse! And by “fun” I mean “you might regret getting that back kitchen.”

Jonathan Levin suggests Wall Street should at the very least start to hedge for the worst by cutting earnings estimates, which it hasn’t gotten around to yet. Look, Wall Street has been dealing with a lot, OK? Goldman took away the free coffee, for God’s sake. But the market may soon have to wake up and smell the possibility of a recession, however unpleasant that might be.

Bonus Markets Reading: The Treasury market is still vulnerable to seizure, and it will take more than clearing to help. — Paul J. Davies

Telltale Charts

As you may have heard, Europe has a bit of an energy problem. Which makes it even more baffling and self-defeating that it drags its feet so badly on building wind farms, Chris Bryant writes.

Wind Resistance

It takes almost 6 years to complete a German wind project

Crypto, SPACs and meme stocks are so 2021. The hot new investment this year is small-town sewer systems, Liam Denning writes. It’s not always 100% clear what private buyers get out of these utilities, but it’s a safe bet customers will be paying more.

Feeling Flush?

All bidders for Towamencin’s wastewater system indicated higher bills, but NextEra’s envisaged them rising by the most – and quickly

Source : Bloomberg

Add Comment